TCA opens Safety Professional nominations

ATA opens Mike Russell award nominations

Bulkmatic Transport picks new president

Kenworth to retire legacy truck models

TFI International was one of the largest transportation and logistics organizations in North America before the acquisition of UPS Freight.

That mega-deal, completed in April, nearly doubled TFI’s size—to $6.5 billion in annualized revenue.

It also stayed in line with the Canada-based company’s signature strategy of swelling shareholder value by sinking free cash into the acquisitions of transportation and logistics companies that slot into one of its four business segments: Less-than-truckload (LTL)—where UPS Freight falls—package and courier, logistics, and truckload.

That’s the same approach that has transformed TFI into one of the biggest players in the bulk transportation industry.

TFI has formed or added seven tank truck operations since 2014, several of which consist of multiple carriers that have been combined, including BTC East, which contains the corporation’s first U.S.-based operations created through the acquisitions of Schilli Corporation, CCC Transportation and Grammer Logistics’ dry bulk business—all since 2019.

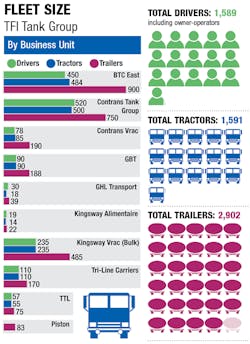

Altogether, TFI’s Tank Group of Companies, part of its truckload segment, now boasts 1,589 drivers, 1,591 trucks, 2,902 trailers—and approximately $500 million in annualized revenue, which ranks among the top five tank truck transporters in the industry.

“A lot of companies talk about acquisitions and growth, and a lot of focus is on expanding,” said Cameron Holzer, senior vice president of operations for TFI, who previously held high-level positions with CRST and C.R. England. “But TFI International really does go out and acquire organizations at a rapid pace, bring them into the family, and then support them with the foundation of transportation expertise that’s been laid.

“And from as high in the organization as any I’ve worked with, the expectation is to reform and improve those businesses.”

Nearly a dozen executives whose operations now are part of TFI recently detailed why they believe the plan is working.

As part of TFI—a significant player in the rapidly evolving world of mergers and acquisitions, where buyers include large carriers, holding corporations and, increasingly, private-equity prospectors—they say they all benefit from streamlined access to resources, safety supports and best practices, while still enjoying operational autonomy from a parent company that’s deeply invested in their individual transportation success.

The same is true in reverse. “Every acquisition has been good for the group,” said Frédéric Lavoie, VP of operations for Kingsway Bulk, one of TFI’s original tank truck entities. “They’ve brought all of us new drivers, new equipment and new customers.”

Acquisitional nature

Alain Bédard, TFI’s current chairman, president and CEO, joined the organization in 1996, bringing with him a bold new plan of expansion through strategic acquisitions.

TFI has added more than 180 companies in the 25 years since Bédard assumed command, and undergone numerous name changes, including the most recent update in 2016, when TransForce Inc.—which debuted in 1999—became TFI International.

The company’s fleet now includes 7,832 tractors, 25,354 trailers and 9,858 independent contractors. It reported 2020 revenues of $3.484 billion, a slight increase from 2019 ($3.478 billion) despite the COVID-19 pandemic and growing driver shortage, and before the addition of UPS Freight, which is a $3 billion business.

TFI now allows 80-plus subsidiaries to operate as independent business units under its umbrella “with a high degree of autonomy,” Bédard reiterated in January. TFI’s primary role, then, is to provide capital, real estate and business supports, while allowing each unit to serve its region and customers as it deems appropriate.

“You can be a lot nimbler that way,” said Steve Brookshaw, an executive vice president who oversees TFI’s specialized truckload division, which includes the Tank Group. “When you’re too big, decisions often are made much slower.”

TFI’s truckload segment, including U.S.- and Canada-based conventional, and specialized truckload, reported revenues of $1.58 billion in 2020. Specialized truckload operations, which include TFI’s dump, flatbed, reefer and other non-conventional fleets, generated 2020 revenues of $749 million, of which Dave Gatti, TFI’s VP of business development, estimated tank carriers contributed $500 million.

Of course, that figure’s subject to frequent revision. TFI’s philosophy of expanding through strategic and opportunistic add-ons remains the same—even as the competition grows.

“We’re looking all the time,” Brookshaw said. “We want to identify companies that best fit our philosophy, and that help our specialty group expand our network from a geographic perspective, or from a product or customer perspective.

“And we know how to run tanks—and the entire transportation and logistics business.”

Group formation

One of the company’s first specialized acquisitions was Lebon Transport in 1998.

Lebon merged with TransForce’s original bulk cargo division to form Kingsway Bulk in 2001. That operation, which now consists of nine tank truck carriers combined over the ensuing years, has eight terminals across Quebec and Ontario—and that’s only one of TFI’s 10 tank truck entities, including its patented Piston Tank lease fleet.

GHL Transport and Kingsway Alimentaire, both located in Anjou, Quebec—along with sister tank repair and maintenance company Centre de Mécanique Henri Bourassa (CMHB)—were acquired in 2008; Contrans Tank Group and Tri-Line Carriers joined in 2014; Contrans Vrac (vrac is the French word for bulk) and GBT (formerly Gorski Bulk Transport) were added in 2018; and Toronto Tank Lines was absorbed in 2019.

TFI also formed BTC East that year, with Schilli, acquired in February 2019, as the base. Grammer’s dry bulk division and CCC were added to the group last year.

Contrans Tank Group was a “mini-TFI” before joining TransForce in 2014, said Dan Roberts, VP of the group, who’s been with Contrans since 1996. Counting the acquisitions before and after it became part of TFI, Contrans Tank’s membership includes the former bulk operations of Archer Trucking, Canadian Bulk Carriers (CBC), Future Transportation, Glen Tay Transportation, Keith Hall & Sons, and Laidlaw Carriers.

Contrans Vrac is another amalgamation of previously family-owned companies, the largest being Villeneuve Tank Lines, which TFI purchased in 2017, and Brasseur Transport, which it acquired in 2018.

“Combining operations is the right move to make, and we are happy to do it,” Roberts said. “We’re all still proud of our original companies, and many of us initially would have liked to keep those names, but eventually that wears off, usually in less than a year. You move on, and realize being under one umbrella is easier.”

Change is hard

In the long run, at least. Acquisitions also come with challenges, including myriad equipment, technologies and operating platforms. The Contrans Tank Group, for example, mostly runs Peterbilt and Kenworth trucks; and equips Gardner Denver blowers on dry bulk trailers, Jabsco pumps on foodgrade trailers, and Paragon coolers on trucks, while other TFI fleets run Internationals or Volvos, and turn to different equipment suppliers.

And there’s always some pain involved—along with unforeseen obstacles to overcome—when organizations change hands, and life-altering decisions are made.

“We’re acquisitional by nature, so we’re always adding, and when new people come in, we don’t tell them it’s all going to be business as usual and nothing will change, because some things will change,” Gatti said. “Some things will change on Day 1, and others will change over time. So that’s a constant challenge within TFI.”

Change is a challenge for many folks, so some resistance is inevitable. But, as Amy Kruntovski, GBT’s safety director, attests, TFI tends to leave its newly acquired operations intact, helping smooth transitions.

“When the merger took place, we weren’t sure what was going to happen,” recalled Kruntovski, who also chairs National Tank Truck Carriers’ Safety and Security Council east region. “Sometimes people just don’t want to be part of it, or part of a big group, and they want to stick with a family-owned type of operation.

“But if you provide the same work environment, the same runs, good equipment, and stay on top of maintenance and safety, you can keep the top drivers. We were lucky to keep most of our management team intact … so we maintained the familiarity with the people running the business, and how we conduct ourselves, which really helped.”

Group benefits

Nothing’s more helpful than tangible benefits, which TFI’s tank truck leaders argue outweigh any drawbacks.

The company’s goal in every deal—which often involves combining carriers based on products or services, or regions served—is to streamline operations, and leverage new synergies and efficiencies. Tri-Line, for example, shares Contrans’ communications system and financial platform, so profit-and-loss reports are standardized, as are key performance indicators. “That’s where the tie-ins come in, so we get the benefits of the mass, and the freedoms of operating as a separate company,” said Dave Stremick, Tri-Line’s director of western operations.

Carriers also gain purchasing power by coordinating equipment orders, and Kruntovski said GBT is updating its equipment more often than it did previously, thanks to the deeper pockets of its corporate benefactor. Regular meetings help leaders manage their markets as a group, promulgate processes and procedures that work, phase out those that don’t, and identify how best to help each other—and their customers.

“It’s difficult for an organization of our size to be a one-size-fits-all, so that’s where our segmented structure becomes a benefit, and our advantage in the marketplace,” Stremick said.

Customers also benefit from the sheer breadth and scope of TFI’s network, which offers access to greater capacity across a wide range of commodities—from a group that works in unison to meet their needs on multiple fronts.

Equally as important, employees also reap rewards from TFI’s exponential growth.

“One thing that’s often lost amid all the activities are the opportunities that are afforded to people, whether they’re a driver who wants to relocate to a new area, or work in regional instead of long haul, or an employee looking to move up,” Gatti said. “I can think of several individuals who were part of Gorski for years who’ve now been given new opportunities.”

Safety in numbers

One of the most important initiatives within TFI’s Tank Group is the streamlining of safety and compliance, and driver training. So Brookshaw charged Geoff Alexander, business resources manager for Contrans Tank, with developing a program that strengthens the group’s safety infrastructure. “As we continue to grow, Steve wants to look at best practices, and once we identify those, how to roll that out to the group, to be more consistent,” Alexander said.

The work began with the establishment of “subject-matter experts” within Contrans Tank in 2018, when Laidlaw and Glen Tay were amalgamated. “We decided that was the perfect opportunity to share services between the safety and compliance divisions,” Alexander said. “So, myself and another safety manager got together, threw everything up on the white board one afternoon, and said ‘Here’s the key functions, and here are the key players.’”

Now, instead of each operation’s safety leader wearing multiple hats, they specialize in key subjects. “We wanted to take the person who best manages accidents, claims, and violations, who has the most experience, get them the right training, and let them manage that file for the entire amalgamated company,” Alexander explained.

Alexander said the approach is working, so they’ve rolled out a similar model across the group.

Now he’s working on setting up TruckRight’s all-in-one compliance, recruiting, and human resources platform group wide. “For the most part, our operations teams in the organization all are on a standard operations software, and our accounting teams, again, all are on the same software,” Alexander said. “But in the safety world, it was whatever the division had, whether it be shared drives, Excel spreadsheets, desktops, or file folders in an office somewhere. So to get to the next level we’ve got to look at software.”

Implementation began in January with the introduction of the Canadian SaaS company’s recruiting software. Now Alexander is helping coordinate group adoption of TruckRight’s learning management system, which enables remote access to pre-employment, post-accident and customer-specific training through one portal. “Where we’re almost at now is, on the driver’s first day with us, they walk in the door and the vast majority of what the in-class training would have been already is complete,” Alexander said.

“That allows us to focus on more hands-on product handling, which is critical for us.

“Phase 3 will be on the compliance end, where we upload tickets, violations, accident and claim data. We’re not there yet, but I’m hopeful that by the end of 2021, we’ll be well into it.”

Tank Group safety personnel already meet weekly to review driver incidents, and any video evidence collected using PeopleNet’s video intelligence system. “Over the years, each terminal would handle their investigation, discipline and training differently,” Alexander said. “With this, incidents go up to a weekly panel and we review them. We look at root causes, and whether or not it’s something that requires discipline. If so, let’s make sure we’re consistent. Or, I’m a big believer in training, so what kind of training is required, or do we bring that driver in, watch the video with him or her, and get their feedback?”

In addition to spec’ing all new trucks with cameras and collision-mitigation systems, Tank Group companies work together on repair and maintenance, by sharing facilities wherever it’s appropriate, promoting tank wash safety, and even cybersecurity, which is a growing problem for businesses across the continent.

Brad Glassford, TFI’s VP of operations for stainless tanks, oversees GBT, TTL and Contrans Vrac operations, and TTL and Vrac both have tank washes. He said they’re focused on reducing confined-space entry with automation.

“You minimize tank entry wherever possible, and we do very little,” he said. “Now we perform most cleaning tasks from outside the tank. We’ve upgraded our spinners, and the processes for every piece of equipment that goes through the wash. We’ve made upgrades as far as monitoring, to better control temperatures, we have accurate readouts as tanks go through different phases of the wash, and it’s more computer-driven.”

Growing together

By working together to promote safety, solve industry challenges, and take care of customers throughout the pandemic, Gatti says they’re in good position to meet surging demand across multiple post-COVID markets.

“In general, across our entire Tank Group, March, April and May of 2020 were challenging,” he said. “But it started to rebound in June, and, for most of our tank companies … by the time we got into July and August of last year, things were starting to take off. When we got into the fall, it was business as usual across most of the Tank Group, and, if anything, since the first quarter of this year, and into April and May, we’re just trying to keep the lid on.

“Now there are days where everybody’s calling each other and asking, ‘Can you help me?’ and we’re having to say ‘No, because I can barely handle the business I’ve got.’”

When they can’t, the driver shortage often is to blame.

Holzer says competition for tank truck drivers is “fierce,” especially in the U.S., and drivers aren’t the only workforce commodity in short supply. Patrick Sarrazin, the director general for GHL and Kingsway Alimentaire, points out that quality mechanics are equally hard to find, and retain. “It’s difficult because we have a lot of competition in Montreal,” he said. “On the same street, they might be able to find four or five different jobs.”

And as they endeavor to shore up workforces and integrate new operations, tank truck leaders keep a close eye on their parent—eager to learn who the next deal will bring into TFI’s ever-expanding Tank Group of Companies.

“As we gain perspective on the events of 2020, it is increasingly clear that TFI International has emerged even stronger, through our relentless focus on the fundamentals, now combined with our transformative (recent) acquisition of UPS Freight,” Bédard emphasized. “As a company, we are exceptionally well positioned to capitalize on the ongoing economic recovery, to generate strong cash flow that we can put toward strategically expanding our business in our quest to create further shareholder value.”

TFI Specialized Transportation Tank Group of Companies

BTC East: Formed 2019

TFI’s youngest group contains its initial U.S.-based tank truck operations. It’s an amalgamation of Schilli (acquired in February, 2019)—whose purchase was the corporation’s first foray into the U.S. tank truck market—CCC (acquired in September, 2020), and Grammer’s dry bulk division (acquired in October, 2020).

Key Products Hauled

Cement, fly ash, and sand; grease and other liquid specialty products; specialized commodities.

Contrans Tank Group: Acquired 2014

One of the largest tank groups in Eastern Canada formed through the amalgamation of many tank carrier operations in Ontario and Quebec (many of which were purchased by Contrans before the TFI acquisition), including Archer, CBC, Future, Glen Tay, Keith Hall and Laidlaw.

Key Products Hauled

Liquid and dry bulk foodgrade products, liquid chocolate, lime, calcium, cement, sand, liquid chemicals and propane. Also haul manifested waste in Canada and crossborder.

Contrans Vrac: Formed 2018

An amalgamation of several former family-owned businesses, the largest being Villeneuve Tank Lines (acquired in April, 2017) and Brasseur Transport (acquired in May, 2018), that boasts rail transloading and tank wash facilities.

Key Products Hauled

Foodgrade kosher liquid, commercial dairy products, and light chemicals.

GBT: Acquired 2018

The company formerly known as Gorski Bulk Transport was established by Ted and Lottie Gorski in 1957 in Ontario, Canada. GBT specializes in hauling foodgrade liquids, and liquids for major auto-industry OEMs; and boasts a long history of international transportation in and out of Mexico.

Key Products Hauled

Foodgrade liquids; liquid chemical products, including resins, lube oils and coolants.

GHL Transport: Acquired 2008

Small carrier specializing in petroleum products and marine operations serving customers and ports throughout Ontario, Quebec and The Maritimes. Sister company CMHB also provides on-site tank maintenance and repair.

Key Products Hauled

Jet fuel, marine fuels, and other petroleum products

Kingsway Alimentaire: Acquired 2008

Small regional foodgrade fleet hauling out of the greater Montreal area.

Key Products Hauled

Liquid and foodgrade dry bulk products

Kingsway Vrac (Bulk): Formed 2001

This amalgamation started as one of TFI’s original tank truck entities, first as part of Cabano-Kingsway, and later serving as Transforce’s bulk cargo division. Vrac now consists of nine small tank truck carriers that have merged over the years, including TFI’s Michel Charbonneau and Transport Bergeron, both added in January.

Key Products Hauled

Chemicals, liquid foodgrade and kosher products, explosives and wood chips, and other dry bulk products.

Tri-Line Carriers: Acquired 2014

Tri-Line, which specializes in dry bulk transportation, is the western-most arm of the Contrans group, which acquired Tri-Line in 2001. It serves building, manufacturing, mining, and oil and gas industries in Western Canada and the Yukon Territories, and in the U.S. Pacific Northwest.

Key Products Hauled

Vast range of dry bulk products, including fertilizers and mining concentrates, cement, sand, lime, calcium, perlite, and landscape materials, in addition to various hazardous waste materials serving the building, manufacturing, mining, and oil and gas industries.

TTL: Acquired 2019

Toronto Tank Lines, founded in 1993 in Hamilton, Ontario, boasts a versatile operation that offers tank storage, rail transloading, port access, and tank and railcar cleaning.

Key Products Hauled

Foodgrade and kosher liquids, specializing in edible oils; biodiesels, waxes, and light lube/white oils.

Piston Tank: Acquired 2019

The specialized trailer leasing division of BTC East offers stainless-steel tank trailers customized with Piston Tank’s patented internal piston that turns a liquid tank into a “caulking gun on wheels.”

Key Products Hauled

Used in transportation of highly viscous products, including grease, paint, ink, caulking, peanut butter, chocolate, and more.