ACT Research forecaster sees bulk tank production growing in 2020, overall economy continuing slow expansion

Frank Maly, director of commercial vehicle transportation analysis and research at ACT Research, shared his firm’s outlook on the commercial vehicle and tank trailer markets during Tank Truck Week 2019 in Nashville, Tennessee.

After discussing economic cycles, and leading indicators and trends, he predicted liquid and bulk tank trailer production levels to be at or below replacement levels in a “challenging” 2020, while also saying ACT does not expect a full-blown recession this year, which is good news for shippers, carriers and manufacturers.

“We’ve had an awful lot of equipment purchases in the last few years, and with some freight demand going down and available transportation volume going up, it’s a supply-and-demand story,” Maly contended. “We’ve had some real tough hits on rates, so that’s not necessarily conducive to this market in 2020.”

The overall economy grew for the 129th consecutive month in January, according to the latest manufacturing report from the Institute for Supply Management. Maly said the US economy averaged 4.4% growth over the last six recovery cycles, which each lasted an average of 81 months. We’ve already blown past that number in this cycle, but growth is at a much slower rate, which Maly pegged at 2.3% from 2009 to 2019.

“It’s kind of a slow-and-steady wins the race, but think of the economy like somebody riding a bike,” he said. “If they’re riding at a fast speed, they’ve got great stability and things aren’t going to get them out of line. When they start to slow down, things might get a little wobbly, maybe the wind pushes them over, and they’re more attuned to shocks that could push them off path.”

With this “wobbly” growth, the economy can’t withstand a lot of “shocks,” he said, and the Purchasing Managers’ Index shows this is a global condition. “We don’t have a whole lot of strength to absorb some of these changes,” Maly said.

Cautionary leading indicators Maly cited included an inverted yield curve (short-term interest rates are longer than long-term rates), which historically is a reliable predictor of recession, stock market volatility, and softening of industrial and agricultural commodities prices.

The ongoing trade war is another key factor influencing the US economy. “We can’t ignore the trade war,” Maly said. “When the big tariffs were announced, money flowed to safety. That’s why interest rates on treasuries went down, because a whole lot of people wanted to buy treasuries. And counter to that, the exchange rate moved as well.”

Despite these concerns, Maly said ACT still is expecting slow economic expansion through 2020, with only a 40% chance of a recession. “We’ve got some global exposure, and we don’t have a lot of risk tolerance anymore because things are growing slower, but consumers are still doing good,” Maly maintained.

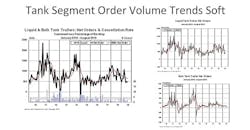

Homing in more on trucking and tank trailers, Class 8 tractor order volumes dipped drastically in 2019 after soaring two years ago, and day cab net orders are at their lowest levels since 2012, Maly said, creating “major concern” about fleet investments. Total trailer orders are following a similar pattern after reaching record levels. But even in a lower market, fleets still are investing in new trailer equipment, Maly said.

Liquid and bulk tank trailer orders have been trending downward since 2018, but cancellation rates remained at reasonable levels for most of 2019. “All in all, the backlog’s been pretty solid,” Maly said. “This is not the case in some major categories like dry vans, reefers and flatbeds. There are some very ugly cancellation numbers there.”

Liquid tank orders have experienced a “more meaningful easing,” he said, while bulk tank orders have stayed fairly flat since 2017. But indicators that impact tank demand, like the flat ACC Chemicals Activity Barometer, weak rig counts and low energy prices, aren’t providing a lot of support for equipment investment.

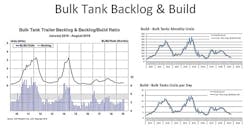

The weaker rig count means oilfield investment is down, which is supported by declining orders of liquid tank trailers. “As the orders went up, now we’re starting to see them slide down,” Maly said. “We had a tracking of backlog-to-build going up through the end of 2018. It is now down fairly significantly from where it was at the end of (2018), or beginning of (2019), but we haven’t seen the big fall in production volumes yet.”

The bulk backlog/build ratio tells a different story, with a flatter backlog indicating OEs have done a good job of managing the environment. “The backlog-to-build ratios actually are growing even though the order backlog is flat,” Maly asserted.

What does it mean? While total trailer production is expected to slide in 2020, tank production should remain solid, with bulk tank production actually expected to increase, from around 1,200 trailers in 2019 (as of Maly’s October 2019 prediction) to 1,500 trailers in 2020, again indicating OEs are successfully navigating the environment.

“We’re going to be up year-over-year but we’re still going to be below the estimated replacement demand (of 1,900 per year),” Maly cautioned.

Liquid tank production is expected to reach approximately 6,000 units in 2020, which is down year-over-year but still above 2016 and 2017 production totals, potentially bringing the market back into balance after an overbuild in 2019.

Caveats for the forecast include potential upside surprises, like higher energy pricing or improved freight-rate profits, and downside risks, including the impacts of the trade war and any easing of regulations that favors shippers. And, of course, don’t forget 2020 is an election year that’s sure to be contentious.

“The evidence overwhelmingly suggests that we’re going to have a challenging year in 2020,” Maly said. “We’re concerned about the overall economy, but we don’t think it’s going to go into recession at this point.”