Expert highlights different valuation strategies, key considerations for storage terminal owners in today’s market

EXPERTS provided an overview of terminal valuation strategies and considerations, and highlighted changes to tax law with the 2017 Tax Cuts and Job Act (TCJA) in “Terminal valuations for today’s market …” during the International Liquid Terminals Association’s 39th annual International Operating Conference.

The session covered trends in terminal sales and valuations in the US and other key markets through real-world examples and valuation case studies, and touched on factors involved in valuation, including cost of building terminals and expanding tankage, understanding and protecting the company from tax liabilities, contract terms and controls.

The following is a summary of the valuation slides presented during the ILTA business session.

Valuations are required for a variety of reasons, including acquisitions and divestitures, fair value and fair market value reporting, tax valuation services, and litigation and dispute; and services may be applicable to various asset classes, including machinery and equipment, financial assets, intangible assets, real property, and operating and holding companies.

The session highlighted three approaches to determining value: Income, including the discounted cash flow method (DCF) and capitalization of earnings method (CCF); market, including the guideline public company method (GPC) and comparable transaction method (GT); and cost, including net asset value method (NAV), depreciated replacement cost (DRC) and depreciated (indexed) historical cost.

Income approach

The income approach requires inputs on prospective financial information, single- or multi-period cash flows, rates of return and long-term growth, and exit multiples and terminal values. Potential challenges with this approach include availability of projections, unobservable industry growth/risk benchmarks and a high level of subjectivity.

The DCF method of income-based valuations, which is more applicable to later-stage companies generating revenue, presents the value of expected future cash flows based on a discount rate that reflects the risk/return expectations of the investment.

Potential benefits of this method include capturing the asset-specific growth trajectory and risk/reward profile, and sidestepping the lack of comparability across peer groups. Limitations include input parameters that can be difficult to estimate, and the possibility of yielding negative values for early-stage projects.

Market approach

The GT market-based valuation method uses recent comparable transactions made by the subject company to compare public or private transactions of similar assets. Also known as the “backsolve method,” the goal is to determine what the total value of the enterprise would need to be for a third-party investor to invest at a given per-share price, accounting for liquidation preferences and seniorities for all share classes in the enterprise.

For example, a $17.5 million transaction price for a 500,000-barrel storage terminal is equal to a value of $35 per barrel.

Valuation expert Jim Harden, a partner at Moss Adams, identified 41 transactions involving the purchase of terminals between 2012 and 2019 that focused on the terminals’ capacity and the total transaction value in a global search of the DrillingInfo transactions database. Moss Adams analysis further classified the terminals into the four categories: Refined products (25 terminals), crude oil (seven) and crude oil plus refined products (nine).

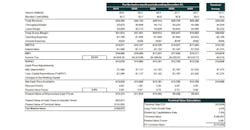

Their comparable transactions research shows the median value per barrel of capacity was $48 for refined products (with an average of $115), $64 for crude oil ($76 average) and $51 for crude oil plus refined products ($66 average).

The GPC market method compares guideline public companies of a similar business to the subject company. The method is easier to understand and apply, but pre-revenue companies lack a basis to apply meaningful multiples, and there is a lack of comparability across peers due to differences in margin and cost structure, location and the competitive landscape.

GPC multiples provided by Moss Adams, using Capital IQ and the Alerian Mastered Limited Partnership (MLP) index featured a median enterprise value of $7,191, median gross profit margin of 38.6%, median EBITDA margin of 28.8%, median debt/EBITDA of 4.19 and median TEV/EBITDA of 11.16 across 16 companies, including Andeavor Logistics, Buckeye Partners, Magellan Midstream, NuStar Energy and Phillips 66 Partners.

Cost approach

The DRC method provides the estimated replacement cost of an asset based on the current replacement cost minus the cost of depreciation, including deductions for physical deterioration and all relevant forms of obsolescence.

The NAV method focuses on restating the individual assets and liabilities on the balance sheet to fair value. This method is easy to understand, Moss Adams said, but it fails to capture intangible assets like contracts, location, future growth and goodwill value.

Tax Cuts and Job Acts

Congress signed TCJA into law Dec 22, 2017, in sweeping tax legislation that made small reductions to income tax rates for most individual tax brackets and significantly reduced the income tax rate for corporations. It also provided a new tax deduction for owners of pass-through entities, increased individual alternative minimum tax (AMT) and estate tax exemptions, and changed taxation of foreign income.

Implications for terminal owners revolve around the reduced corporate tax breaks, along with interest expense deduction limitations, limitations on net operating losses (NOLs) and accelerated capital expensing.

In regard to corporate tax rates, Moss Adams said valuations should utilize the new corporate rate (21% plus applicable state and local tax rates). The new rate impacts the discount rate and the capital asset pricing model, given the limitation of the deductibility of interest expenses, and also impacts pass-through entities.

Deductions for net interest expenses are limited to 30% of adjusted taxable income. There’s no change for profitable, low-leverage companies with TCJA, but the deduction impacts the discount rate for medium- to high-leverage companies.

Use of NOLs is limited to 80% of taxable income. Losses can be carried forward to offset future income indefinitely, but carrybacks generally are disallowed.

Accelerated capital expensing allows for immediate expensing (ie 100% bonus depreciation) for qualified assets acquired and placed in service on or after Sept 27, 2017 and before Jan 1, 2023. The capital expensing provision is likely to result in a larger disparity between book depreciation and tax depreciation, Moss Adams said.