Buoyed by a U.S. economy that is on “solid footing,” the American Chemistry Council expects chemical output volumes to grow by 2.2% in 2024 and 1.9% in 2025, with the largest gains in the Gulf Coast and Midwest regions, according to the council’s 2024 mid-year situation and outlook report.

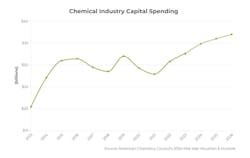

Competitive energy fundamentals and the resurgence in U.S. manufacturing from “once-in-a-generation” legislative initiatives to promote clean energy, infrastructure, and a strong domestic manufacturing base also contribute to ACC’s view that prospects for U.S. chemistry “remain positive.”

“Looking ahead, the U.S. economy will drive up demand across many key chemistry end-use industries, which should tee up a healthy increase in chemical output,” Martha Moore, ACC chief economist, said in a blog post. “This promising outlook is dampened by the rising regulatory impact on the chemical industry, which threatens to undermine America’s competitive advantages in energy and the potential growth generated by the rebound in U.S. manufacturing.”

Moderate gains in chemical demand

The majority of basic and specialty chemicals are consumed by the industrial sector and the outlook for industrial production, while improved compared to 2023, remains comparatively weak, ACC reported. Overall industrial production rose just 0.2% in 2023 and a similar modest gain is expected in 2024 before rising by 1.7% in 2025. Led by a recovery in consumer goods and investment gains, industrial production is expected to expand more during the second half of the year.

Following 16 months of consecutive contraction, U.S. manufacturing expanded in March according to the ISM Manufacturing PMI, but fell back into contraction territory in April and May. Performance in the industrial sector has been uneven. ACC anticipates a turnaround this year with 12 of the 18 key chemistry end-use industries it tracks expanding in 2024. Industries tied to automotive, aerospace, and electrical/electronics fare the best, while industries linked to housing and industries in structural decline are expected to continue to struggle for the rest of the year.

The average automobile built in North America contains more than $4,400 of chemistry products, including 426 lbs. of plastics and composites, making it an important end-use industry for chemical producers. Following four years of below-average sales, there is pent-up demand for vehicles. With higher borrowing costs and uncertain economic conditions, growth in vehicle sales is expected to edge slightly higher to 15.7 million in 2024 and 16.3 million in 2025.

Chemical production grows in 2024

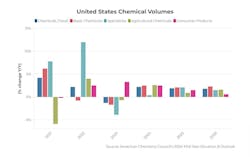

The past year was a tough one for chemical producers as an unprecedented destocking cycle curbed production, which was down 1.3% in 2023. With inventories in a more balanced position and nascent signs of firming demand in several end-use markets, ACC expects chemical output volumes to grow by 2.2% in 2024 with gains across all segments. Output is expected to grow 1.9% in 2025.

This is consistent with the findings of ACC’s Economic Sentiment Index that found chemical firms felt overall business activity and major customer demand improved in Q1 and are expected to continue to improve over the next six months. Because of the chemical industry’s early position in the supply chain, ACC expects to see a turnaround in chemicals before improvement in the broader economy.

ACC anticipates output of basic chemicals in the U.S. to rise 2.5% in 2024 with gains in petrochemicals and organic intermediates, inorganic chemicals, and plastic resins. Plastic resins output will continue to grow, up 2.9% in 2024, in part due to stronger exports. Specialty chemical output is also expected to rise in 2024, though at a more modest 0.4% reflecting the slow recovery in end-use markets. Output of agricultural chemicals is expected to rise 2.6% with gains in both fertilizers and crop protection chemicals. Production of consumer products which grew strongly last year will continue to expand at a slower 2.5% this year. In 2025, ACC expects both basic specialty chemical output to rise by 2.1%. agricultural chemicals and consumer products will also continue to expand by 0.9% and 1.5% respectively.

The longer-term outlook for U.S. chemistry is positive with the natural gas liquids feedstock advantage continuing to favor U.S. production for the foreseeable future. Capacity expansions in customer industries motivated by recent legislation will create demand for U.S. chemistry. In addition, shortening of supply chains and the impact of Section 301 tariffs have motivated new investment in Mexico and the re-/near-shoring of manufacturing that will strengthen the North American manufacturing base. Because Mexico and Canada are the industry’s largest trading partners, expansion in Mexican manufacturing bodes well for U.S. chemical.

Longer-term outlook and risks

Prospects for U.S. chemistry remain positive, but the rising regulatory impact on the chemical industry in the U.S. remains one of the largest risks to this outlook, potentially undermining competitive advantages in energy and opportunities provided by the manufacturing expansion. “If left unchecked, the dramatic rise in regulations focused on the chemical sector could incentivize companies and production to move offshore, potentially to parts of the world where chemical production is more carbon intensive,” ACC maintained.