Reports: Economic uncertainty slows truck orders

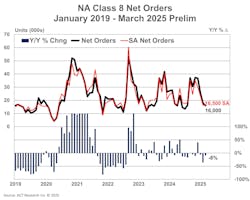

Class 8 orders declined year-over-year in March, according to the latest data from ACT Research and FTR Intel.

ACT reported net orders of 16,000 units, down 8.3% year-over-year.

“The first quarter of 2025 has been defined by one word: uncertainty,” Carter Vieth, ACT research analyst, said in a news release. “Whether the slowdown in orders is a result of moderating economic activity, private fleets’ pausing expansion, or a response to trade and policy uncertainty is difficult to surmise and remains an open question. In March, Class 8 orders decreased 8.3% year-over-year to 16,000 units.

“Seasonally adjusted, Class 8 orders were up slightly, increasing 1.1% from February to 16,500 units (198,000 SAAR), one of the lowest one-month SAAR readings in almost three years.”

FTR recorded orders for 15,700 Class 8 trucks in March, a decline of 14% month-over-month and 22% year-over-year. The figure was significantly below the seven-year March average of 24,760 net orders and represented a slightly larger-than-expected seasonal month-over-month decline, FTR said. The vocational market accounted for the bulk of the month-over-month declines, although on-highway orders were predominantly weaker as well.

Class 8 orders for the past 12 months now total 277,927 units.

The implementation and continued threat of tariffs among North American trading partners combined with ongoing economic and freight market uncertainty have dampened fleet investment in Class 8 trucks and tractors in recent months, FTR added. The situation is further complicated by anticipated revisions to the U.S. EPA’s 2027 NOx regulations.

“Persistent uncertainty in tariffs, the economy, freight, and regulations could notably disrupt fleet replacement cycles—potentially prompting fleets to either accelerate purchases ahead of expected price hikes or, more likely, delay investments until market conditions stabilize,” said Dan Moyer, FTR senior analyst for commercial vehicles. “The latter scenario appears supported by the 25% year-over-year decline in net orders for 2025 to date. Cumulative net orders for the 2025 order season (September 2024 through March 2025) were down by 8% year-over-year as well.

“New and pending U.S. tariffs and retaliatory tariffs are expected to significantly increase costs for North American Class 8 trucks, tractors, and related components. OEMs and suppliers may consider shifting production to mitigate tariff exposure, but such strategic adjustments are costly, complex, and time-consuming, further complicating industry planning.”