Construction contractors have a “decidedly mixed” outlook for 2024 as firms predict transitions in demand for projects, the types of challenges they will face, and the technologies—including artificial intelligence—they plan to embrace, according to recent survey results from the Associated General Contractors of America.

Amid all of these changes, contractors are struggling to cope with “significant” labor shortages, the impacts of higher interest rates and input costs, and a supply chain that, while better, is far from normal, AGC maintained.

“[This year] offers a mixed bag for construction contractors: on one hand, demand for many types of projects should continue to expand and firms will continue to invest in the tools they need to be more efficient,” AGC CEO Stephen E. Sandherr said in a news release. “Meanwhile, they face significant challenges when it comes to finding workers, coping with rising costs and weathering the impacts of higher interest rates.”

AGC’s “A Construction Market in Transition: The 2024 Construction Hiring and Business Outlook,” was produced in association with Sage, a business software firm.

Cautious optimism

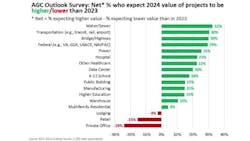

The net reading—the percentage of the survey respondents who expect available dollar values of projects to expand compared to the percentage who expect it to shrink—is positive for 14 of the 17 categories of construction included in the survey, as it was in 2023. However, a smaller share than previously reported expects the markets they compete in to expand in the coming year. The net reading decreased from the 2023 survey for nine project types, increased for six types, and remained unchanged for two.

The highest net positive reading in the 2024 survey—32%—is for water and sewer construction. That category edged out last year’s leading segments, highway and bridge construction and transportation projects such as transit, rail, and airports. And the net reading for federal projects is 29%, AGC official added. The highest expectation among predominantly private-sector categories is for power projects, with a net reading of 25%. Close behind are the readings for hospital construction, with a net of 23%, and non-hospital healthcare facilities, such as clinics and medical labs, with a net of 22%.

The largest increase in optimism from the previous survey is for data center construction, with a net positive reading of 20%. That is up from 12% a year ago. Contractors are optimistic, as well, about the education sector. The net reading is 18% for kindergarten-to-12th-grade schools and 15% for higher education construction. The net reading for both public buildings and manufacturing construction is 15%. The net is 10% for warehouses.

There are four market segments for which respondents are closely divided between favorable and unfavorable outlooks or have negative expectations on balance. There is a net positive reading of 4% for multifamily residential construction. Expectations are bearish for lodging, with a net negative reading of minus-3%; retail construction, minus-15%; and private office construction, minus-24%.

“On balance, contractors remain upbeat about the available dollar value of projects to bid on in 2024,” said Ken Simonson, AGC chief economist. “But the optimism regarding opportunities for most project types is less widespread than it was a year ago.”

Overcoming challenges

Simonson noted that more than two-thirds (69%) of the respondents expect to add to their headcount, compared to only 10% who expect a decrease. While just under half (47%) of firms expect to increase their headcount by 10% or less, nearly one-quarter anticipate larger increases.

However, 77% of respondents report they are having a hard time filling some or all salaried or hourly craft positions. The majority (55%) expect that hiring will continue to be hard (35%) or will become harder (20%).

Most firms took steps in 2023 to attract and retain workers. Sixty-three percent increased base pay rates more than in 2022. Additionally, 25% of firms provided incentives or bonuses and 24% of the firms increased their portion of benefit contributions and/or improved employee benefits.

As in the past two surveys, nearly two-thirds of respondents say projects have been postponed or canceled. Almost equal percentages of firms report projects were postponed or canceled in 2023 and not rescheduled (36% of respondents) as report projects were postponed but rescheduled (37%). Ten percent have already experienced postponement or cancellation of a project that had been scheduled for the first half of 2024.

Only 23% of respondents say they have not had any significant supply-chain problems. However, 64% noted that rising interest rates or financing costs are one of their biggest concerns for 2024, while 63% listed insufficient supply of workers or subcontractors and 62% are worried about the likelihood of an economic slowdown/recession. In addition, 58% listed rising direct labor costs (pay, benefits, employer taxes), while 56% pick worker quality and 54% list materials costs as major concerns for the year.

Officials with Sage noted that construction firms have been seeking ways of adapting to the shortage of skilled workers and improving jobsite safety and productivity. Nearly 40% of firms say they will either increase their investment in drones (26%) or make an initial investment (14%). Thirty percent of firms will make an initial investment in artificial intelligence (19%) or increase their investment (11%). And almost 30% plan to make more use of offsite production (21%) or start to (9%).

“Technology has played an instrumental role in helping construction firms build more efficiently while navigating current challenges,” said Dustin Stephens, Sage vice president of construction and real estate. “In this era of digital transformation, technology serves as a cornerstone for sustained growth and success.”

Stephens added that nearly all firms plan to increase or keep level their investment in software. The most likely candidates for increased software spending are accounting software and project management software—for each type, 38% of respondents expect to increase their investment. Close behind is document management software, cited by 36% of firms. Thirty-one percent plan to increase spending on estimating software.

Official assistance

Association officials said that many of the challenges contractors are facing depend on the actions of public officials to address. If the Biden administration were to act on Congressionally mandated permitting reforms, many more infrastructure and construction projects would start this year, countering the small impact those investments have had to date. And if public officials would narrow the five-to-one funding gap between college-prep programs and career and technical education, more students would be exposed to construction and would likely pursue careers in the field.

“We will continue to urge the Biden administration to implement mandated reforms to the federal review and permitting process and otherwise ensure that the federal government no longer serves as the biggest obstacle to its own construction investments,” Sandherr said. He added that the association will be pushing for new funding for construction education and training programs as part of both the Workforce and Innovation Opportunity Act and the Pell Grant reauthorization legislation that are expected this year in Congress as well as immigration reforms.

“We are committed to working with policy makers and our members to make sure the conditions are right for firms to be successful in their efforts to improve the nation’s infrastructure, modernize manufacturing, and build an even stronger economy,” Sandherr concluded.