Slower growth in freight volumes outweighed a slight contraction in capacity in December, according to the latest release of ACT’s For-Hire Trucking Index.

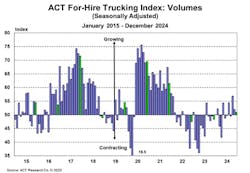

Volumes

The Volume Index decreased by 1 point month-over-month to a seasonally adjusted 51.0, ACT reported.

“Despite the economy continuing to exceed expectations, particularly consumer spending, for-hire volumes have yet to find meaningful purchase out of the trough,” Carter Vieth, ACT research analyst, said in a news release.

“While freight is growing broadly, two years of private fleet capacity additions have diminished for-hire carriers’ slice of the freight pie. Additionally, while the retail sector is healthy, interest rate sensitive sectors like manufacturing and construction are sluggish. Tighter financial conditions are likely to slow volumes in these sectors, despite support from hurricanes and wildfires.”

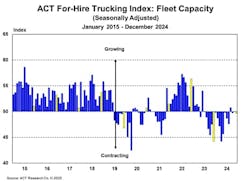

Capacity

The Capacity Index essentially stayed flat, ACT said, declining just 0.3 points month-over-month to 49.7 in December.

“Approaching three years of weak profitability, for-hire carriers aren’t in the position to add significant new capacity,” Vieth said. “Given the current volume and rate environment, we would anticipate for-hire capacity additions to remain at replacement levels, leaving the index at or around 50.”

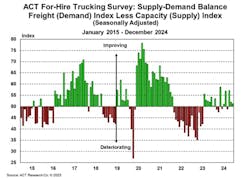

Supply and demand

The Supply-Demand Balance grew at a slower rate in December, moving to a seasonally adjusted 51.3 from 52.0 in November, as the slower growth in freight volumes outweighed the slight contraction in capacity.

“Private fleet expansion, which is not captured in this indicator, has resulted in a longer period with the market close to balance than in past cycles,” Vieth concluded. “Consumers remain robust, and inflation is in relatively good shape for now. But sustained high interest rates could dampen demand in construction and industrials and may limit volume improvement in the near term.

“A slowdown in private fleet growth is likely and should lead to further improvement in the for-hire market balance.”