Latest from Trucks

Hendrickson invests in solar energy

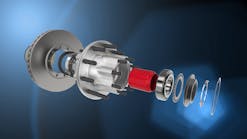

ConMet marks 30 years of PreSet hub tech

Peterson celebrates 80 years of innovation

Mack Trucks celebrates 125 years

Class 8 truck orders improve in December

Peterbilt adds LED pod headlights for 589

THE LATEST versions of natural gas-fueled engines for heavy-duty trucks got a good workout during a recent media event conducted by Kenworth Truck Company. The engines, including the new Cummins Westport 12-liter spark ignition power plant, drew praise from the participants.

These engines performed every bit as well as their diesel-fueled counterparts. They demonstrated plenty of power and torque, and they were quieter than many diesel-fueled engines. The spark ignition engines have the added benefits of lower weight and a much simpler emission control system because they don't need the selective catalytic reduction technology.

Significantly lower fuel costs remain a competitive advantage for natural gas-fueled trucks, and the fuel (both liquefied and compressed natural gas) is becoming more readily available where commercial motor vehicles operate. Recent CNG fuel prices averaged just $2.08 a gallons, compared to diesel prices of at least $3.68. Since 2005, the price margins have remained at least 25% and have reached as much as 40%. Substantial price margins are expected to remain between natural gas fuels and diesel for at least the next 10 years, according to a recent study by SBI Energy.

Slightly more than half (51.4%) of carriers said in a recent survey that they are now considering natural gas power when purchasing new trucks. More and better natural gas-fueled engines were among the positive factors driving carrier interest. Transport Capital Partners and ACT Research conducted the survey.

On the downside, 94% of the survey respondents remain concerned about fuel availability, 90% see higher vehicle purchase prices as a significant obstacle. Additional concerns include needed product specs/performance (51.4%) and secondary market value (50%).

Clear trend

Nonetheless, the trend toward natural gas-fueled vehicles is unmistakable. Recent estimates suggest sales of 5,100 natural gas-fueled Class 8 trucks this year and steady growth over the next four years: 9,500 trucks in 2013, 12,500 in 2014, 16,400 in 2015, and 18,500 in 2016.

“Overall, 2012 has been a great year for all of us supplying natural gas trucks,” says Andy Douglas, Kenworth Truck Company's national sales manager for specialty markets. “There is no lack of interest in natural gas-fueled trucks, and we see fleets ordering 340 to 40 trucks at a time.

“More engines are available, and fuel suppliers are meeting their goals to expand the fueling infrastructure. There is a lot more natural gas out there as a truck fuel, with still more coming. We're seeing relatively strong resale number for natural gas-fueled trucks although the volumes of used natural gas-fueled trucks are still small. Resale values are comparable to used diesel trucks.”

What to consider

For those ready to seriously explore the purchase of natural gas trucks, Douglas has the following recommendations:

“Start with two primary considerations when spec'ing natural gas-powered trucks — first, the type of natural gas available in your operating area, and second, the operating range your trucks typically travel,” he says.

Before choosing compressed natural gas (CNG) or liquefied natural gas (LNG), it is important for fleets and operators to take inventory of natural gas stations in their area and along their operating routes. “Currently, many local transit and government agencies use CNG to power trucks and buses, so that fuel source may be easier to find,” Douglas says. “Meanwhile, the natural gas infrastructure available to the public is expanding at an accelerated rate across the United States and Canada along well-traveled transportation routes.”

For example, natural gas engine manufacturer Westport Innovations in Vancouver BC, Canada and Shell have agreed to launch a co-marketing program in North America aimed at providing customers with a better economic case for adopting natural gas-powered vehicles by addressing fuel supply and customer support.

Chesapeake Energy announced last year that it would invest $150 million in Clean Energy Fuels Corp over the next three years to help underwrite approximately 150 LNG publicly accessible fueling stations for heavy-duty trucks along major interstate highway corridors.

“It's amazing the amount of infrastructure activity that's happened in the past five years,” he says. “It may not be too long before we'll see enough natural gas stations along key interstate corridors for trucks to be able to travel from Los Angeles to New York and back.”

Operating range

Besides natural gas fuel availability on your route, take into account operating range. “In general, if your operating range is over 400 miles, it's usually best to go with LNG,” Douglas says. “Under 400 miles, CNG can be an option. CNG can be used up to 66,000 pounds GVW with some severe duty applications going up to 80,000 pounds GVW.”

In addition to available fuel type, be sure to check each filling station's ease of truck accessibility, and capability to fill commercial truck volumes. Most CNG stations compress the gas into onsite storage cylinders, which can then dispense the natural gas fuel into truck fuel tanks as quickly as diesel fuel. LNG can be dispensed at 20 to 40 gallons per minute; so fueling a truck with 120-gallon tank capacity may typically take less than five minutes.

“Drivers can refuel CNG-powered trucks without needing to go through special training,” Douglas says. “LNG is a cryogenic fuel and so those vehicles must be refueled by properly trained individuals.”

Some CNG stations are lower volume, or time fill, and fill fuel tanks more slowly. The slower, time-fill system is often used to fuel fleets whose vehicles sit overnight or for several hours, he said. As far as fuel tank selection, there is sometimes a tendency to overspec when choosing natural gas tanks since operators are in the habit of carrying a two-to-three day supply of fuel on their diesel trucks.

“In many cases, it's often impractical to carry much more than a day's supply of natural gas. Natural gas fuel tanks also can be expensive, so consider carrying only enough fuel for a full-day's work, plus a 10 percent reserve,” Douglas says.

Fuel tanks

Douglas recommends specifying Type 4 CNG cylinders, which are the lightest weight, but also the most expensive option. Type 4 tanks have a plastic core and are fully wrapped with a composite, such as carbon fiber. Other less expensive options are Type 2 and Type 3 CNG tanks, which have a steel or aluminum core and are composite wrapped. All CNG tanks are high-pressure vessels.

For its LNG-powered T800s, Kenworth uses a Dewar flask (or cryogenic tank) system that is like a large Thermos bottle inside a metal cylinder. The LNG fuel tank, which is designed to keep the fuel in its liquid state at minus 260 degrees Fahrenheit, can hold between 56 and 80 diesel gallon equivalent (DGE) gallons per tank.

Fuel tank placement depends on the type of truck, chassis configuration, equipment specification choices and how much fuel is needed to be carried, he says. “It's important to carefully consider the possible impact of tank placement choices on wheelbase length, weight distribution and turning radius.”

Engine choices

Douglas also offers engine recommendations for spec'ing natural gas trucks. Like many in the industry, he praised the rollout of the new Cummins Westport ISX 12 G spark-ignition engine that can run on CNG or LNG. Available in early 2013, the engine comes with a range of power ratings up to 400 horsepower and 1,450 lb-ft of torque. A variety of engine brake and manual and automatic transmission options are available. For emission control, the engine uses a maintenance-free, three-way catalyst.

“The ISX12 G is a perfect size for the operational needs of regional and refuse haulers that require a little more power and torque than offered by the ISL G, but that don't need as much as provided by the Westport HD,” Douglas says. “We think the ISX12 G really opens the door for many operators in regional, refuse, and pick up and delivery applications to consider natural gas as a viable choice for an engine platform.”

That doesn't mean the other natural gas engine options will lose favor. “If you choose LNG, the 15-liter Westport HD engine is a good choice for Class 8 applications, including regional haul, linehaul, port, and drayage with loads requiring more power and torque,” he says.

The Westport HD engine uses approximately 95% liquefied natural gas, and 5% diesel as the pilot ignition, thus requiring the use of selective catalytic reduction (SCR) technology and a diesel particulate filter (DPF). For a regional or line haul operation, Douglas recommends an LNG truck with two tanks. “If you specify, say a 120-gallon and a 70-gallon tank, that configuration provides about 100 DGE for an operating range in the neighborhood of 500 miles — without severely impacting wheelbase,” he says.

For fleets operating routes that are less than 400 miles, Douglas suggests considering the CNG system with the 8.9-liter Cummins Westport ISL G natural gas engine. The engine uses a maintenance-free, three-way catalyst and is 2010 EPA- and CARB-compliant without the use of SCR/DEF system. “The three-way catalyst offers customers less weight and complexity and can result in lower running costs,” he says.

The ISL G is rated at 320 hp and 1,000 lb-ft of torque for the Kenworth T440 and Kenworth W900S for local and vocational applications, and has a torque curve closely matching that of its diesel counterparts. The ISL G is spark-ignited and can operate on either LNG or CNG. Some tank fleets report very good success running the ISL G with LNG fuel.

Automatic transmission

Combined with the use of an automatic transmission, which improves throttle response and torque management, superior pulling power is provided to get the job done. The ISL G is recommended for tractors with a GVW of 66,000 pounds or less, but waivers are being granted for tank fleets hauling 80,000 pounds in some applications.

For CNG, Douglas recommends specifying either two saddle tanks or four vertical back-of-cab headache tanks. “That gets you about 76 to 81 DGE, which equates to up to 400 miles travel with CNG,” he says. “Vocational applications, such as a cement mixer, would also be better served with the choice of CNG because of the more local nature of the application.”

The ISL G is also 5-1/2 decibels quieter than comparable diesel-powered 2007 Cummins engines at peak torque and load and nearly 10 decibels quieter at idle, according to Cummins Westport. The company reports it has produced 10,000 ISL G natural gas engines, mostly for the school bus and commuter bus markets, since the engine's launch in 2007. According to recent figures from the US Energy Information Administration, the average cost of diesel in the United States reached $4 in November 2011. That's up just over 25% from the same period a year earlier.

“The price of natural gas over the past three years has been consistently lower than diesel, in some cases by as much as $2 per diesel gallon equivalent,” he says. “It's no wonder natural gas has drawn increasing interest among truck and fleet operators. The fuel savings, coupled with the longer trade cycles that some vocational operators already experience with their trucks, can make a positive return on investment (ROI) attainable now, even without government incentives. The business is changing as the trend moves toward greener trucks.”

To help determine if that savings can provide a high enough ROI, Douglas said the Clean Cities Alternative Fuel Price Report offers a comparison of CNG, gasoline, diesel and biodiesel fuels on a straight price comparison basis and an energy-equivalent basis. The report is updated every three months.

“Natural gas represents a tremendous future for our industry,” Douglas says. “Knowing how to choose the right model, fuel, tanks, and engine is important for truck fleets and operators looking at adding natural gas units to their operations.” ♦