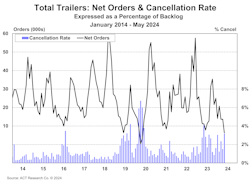

Net U.S. trailer orders decreased month over month in May, according to new data from industry analysts ACT Research and FTR Transportation Intelligence.

ACT pegged the May tally at 6,100 units, and FTR reported 5,766 orders in May.

ACT’s count is down 7,650 trailers from April and 46% lower year over year, bringing year-to-date order activity to 68,200 units, which is 25% lower than the first five months of 2023, with its faster-paced order environment, pent-up demand, and moderately congested supply chain.

“Seasonally adjusted, May’s orders were nearly 7,200 units compared to a 17,300 SA rate in April,” Jennifer McNealy, ACT director of CV market research and publications, said in a news release. “On that basis, orders decreased 59% month over month. Dry van orders contracted 85% year over year, while reefers, albeit at low volumes, were still an improvement from last May’s negative net order tally.

“Flats were 37% lower compared to May 2023.

“Total cancellations again oscillated to the higher side of the pendulum’s arc in May. The cancellation rate rose to 3.2% of the backlog, from April’s 1.5% rate. Eight of 10 markets remained at or above the 1% mark, with OEMs indicating cancellations from multiple fleets and dealers.”

FTR reports U.S. trailer orders fell 56% from the April level, leaving them down 14% year over year and 65% below the average for the last 12 months.

The number of trailers ordered over the last 12 months now totals 198,200 units, FTR added.

The May decrease was primarily driven by a substantial drop in gross orders coupled with the sustained high level of cancellations. Trailer production decreased by 5% month over month and 22% year over year in May, totaling a still relatively high level of output at 21,781 units. This build level is 10% lower than the average May level over the past five years.

With net orders coming in substantially below production levels, backlogs in May dropped, falling by almost 18,500 units to end at slightly more than 128,500 units. The larger month-over-month decrease in backlogs than in production resulted in a decrease in the backlog-to-build ratio to 5.9 months. This ratio is the second lowest level since 2020 and is right in line with the historical average prior to 2020. The current ratio indicates little overall incentive for trailer manufacturers to adjust production levels.

“Truck freight hasn’t entered a recovery yet despite occasional signs of improvement,” said Dan Moyer, FTR senior analyst for commercial vehicles. “The softness is particularly reflected in this month’s lower orders in the dry van and refrigerated van segments, although reefer van orders are still up year over year for 2024 to date. Strength in the vocational market appears to be bolstering flatbed orders.

“With trailer orders surprising on the downside, backlogs continuing to decrease, and high trailer dealer inventory, build levels, and rates will face increasing downside pressure as we continue through the slower summer order months.”