U.S. residential electricity prices will increase by about 1% in 2024, the slowest rate of year-over-year growth since 2020, according to the latest forecast from the U.S. Energy Information Administration (EIA).

Natural gas prices have been falling since late 2023, and those lower prices now are being factored into retail electricity rates, EIA explained.

Natural gas provides the largest share of U.S. electricity generation.

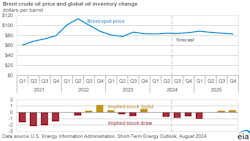

Conversely, EIA anticipates the Brent crude oil price could increase to about $87 per barrel by the end of the year. The Brent crude oil price is currently below $80 per barrel. EIA expects continued oil production cuts from OPEC+ will reduce global oil inventories through the first quarter of 2025, which is likely to push oil prices up.

“The good news from a consumer perspective is that even though we expect oil prices to increase, we expect gasoline prices through this year and next year to remain lower than they were in 2023,” EIA Administrator Joe DeCarolis said in a news release. “U.S. motorists are using less gasoline than they did before the pandemic, and we expect that to help keep gasoline prices from climbing with oil prices.”

Other highlights from EIA’s August Short-Term Energy Outlook include:

- Natural gas. EIA expects about 2% less natural gas will be consumed to generate electricity in the United States in August than in July, as U.S. temperatures trend closer to normal and demand for air conditioning eases. U.S. natural gas consumption to generate electricity set a monthly record in July, even as Hurricane Beryl left millions of homes and businesses in Texas without electricity for several days at the beginning of the month.

- Jet fuel. EIA expects U.S. jet fuel consumption will exceed pre-pandemic levels in 2025. U.S. jet fuel consumption is primarily driven by commercial air travel demand, which can be influenced by economic activity, employment, and the cost of air travel. Sources of uncertainty in the forecast include aircraft supply chain issues that could worsen aircraft shortages and air traffic controller shortages.