‘Rolling recession’ in U.S. economy slows trucking’s recovery

Trucking companies typically prefer to keep things rolling. Recessions, it turns out, are a painful exception.

Paul Lee, Institute for Supply Management (ISM) director of research and analytics, reviewed the concept of a “rolling recession”—in which many experts say the U.S. is mired—and explained why it’s a pernicious problem during National Tank Truck Carriers’ 2023 Annual Conference in Boston, Massachusetts.

“That isn’t a good thing because it means different sectors of the economy are going through the recession at different points, and you don’t see the overall cooling you need to get inflation to come down,” he told NTTC’s energy services, and chemical committees. “What you see is pain rolling through the economy, and until we start to cool off a little bit more, we won’t be finished with government intervention in financial markets.”

The prospect of further interest rate hikes by the Federal Reserve certainly is unpleasant, but it’s unsurprising to carriers already dealing with a freight recession that has left market conditions “at or near the bottom,” Avery Vise, FTR vice president of trucking, said after FTR released its March Trucking Conditions Index. Unfortunately, Lee also said chemical products—where many tank truckers have focused their recent expansion efforts—have “underperformed” compared to other manufacturing sectors.

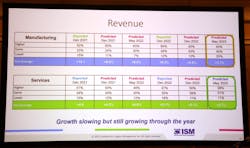

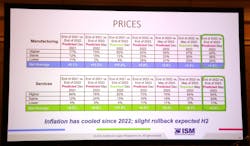

But Lee also shared some good news with attendees, saying petroleum and coal products have performed relatively well, and ISM now expects prices to “roll back” in manufacturing and services in the second half of this year while discussing ISM’s latest Report on Business—which covers all aspects of business operation, from sales and production, to imports and exports—and newly released Spring 2023 Semiannual Economic Forecast.

“When we broke this down [in December 2022 for ISM’s fall economic forecast], manufacturing was expecting a recession to hit in the first half of the year, with recovery in the second half,” Lee reported. “Now we’ve all seen that didn’t happen, so expectations have been pushed out compared to the end of last year.”

Real-time reporting

ISM, founded in 1915, is the oldest association for supply chain professionals in the world. The organization boasts 50,000 members who manage $1 trillion in corporate and government spend. ISM began publishing its Report on Business in 1931 after President Hoover requested a briefing on the work of supply chain managers, who he believed were the “nexus of supply and demand,” Lee relayed. The now-30-page report features qualitative and quantitative analysis of 36 manufacturing and services sectors, including a Purchasing Managers Index (PMI) and 10 sub-indexes, and board-selected comments from over 1,000 monthly respondents.

Manufacturing represents only 12% of the U.S. Gross Domestic Product (GDP)—down from approximately 24% 30 years ago—but is considered a “bellwether of economic performance” in the U.S. by financial and government institutions, who pay close attention to ISM’s numbers, Lee said. The top six sub-sectors represent 70.3% of total U.S. manufacturing GDP. Computer and electronic products, to no one’s surprise, are No. 1 on the list, representing 16.4% of U.S. manufacturing efforts, chemical products (14.8%) are second, transportation equipment (13.9%) is third, and petroleum and coal products (6.5%) rank sixth.

Services represent 88% of U.S. GDP. The top six sub-sectors make up 61.2% of U.S. services GDP, and include No. 1 real estate, rental, and leasing (13.7%), No. 2 government (12.8%), and No. 3 professional, scientific, and technical services (9.8%).

Big picture

ISM’s PMI for manufacturing and services has trended downward since the fall of 2021. But while manufacturing has consistently declined, services have only recently begun to dip, and not as much as regulators want to see, Lee said. “This is actually pretty hopeful, even though it’s painful,” he asserted. “If services start to follow that trend a little bit, maybe we’ll get some respite from the interest rate increases.”

New orders have slowed since October 2021. Manufacturing new orders declined for the ninth consecutive month in May, registering 42.6% on ISM’s index. Anything above 50% is expanding and anything below is contracting. “People have been waiting to see that percolate into the services sector but it’s not doing that up to this point,” Lee said. On the flipside, with the backlog of orders, manufacturing dropped below 50% in September 2022 but services didn’t begin to contract until this past March. “You’re not seeing enough production eating into what’s already been ordered,” Lee elaborated.

Supplier deliveries, overall, have moderated since the fall of 2021, indicating supply chains are improving, and the pace of price increases has slowed since March 2022, Lee said. ISM’s Prices Index hit 44.2% in May. But service business activities have yet to dip below 50%, and manufacturing production, which fell below 50% in December, rebounded to 51.1% in May, further delaying the economy-wide downturn many expected. “When we get into a recession, we’ll see both these sectors below [50%],” Lee said. “And typically what happens is we hit a recession after they’ve been below the black line for a couple of months. But the recession people thought was coming the first half of the year didn’t materialize.”

Petroleum and chemicals

Petroleum and coal products helped prop up the economy in the first four months of the year, performing well relative to other sectors of the manufacturing economy, Lee said. However, the sector reported contraction in May. “Generally speaking, petroleum and coal products have had a relatively good time of it over the last year,” Lee said. New orders contracted only once between May 2022 and April 2023, and the sector’s backlog indicates sales largely have remained in balance with production and deliveries. “Earlier in the 12-month period, there were a couple of spikes [in the backlog of orders],” Lee said. “In fact, in July, petroleum and coal products had the best performance relative to the other 17 manufacturing sectors.”

Petroleum and coal products enjoyed a “pretty good production run about six months ago” before flattening out, Lee added, while supplier deliveries and input prices have been “up and down,” revealing volatility.

Chemicals, on the other hand, have “mostly underperformed compared to other sub-sectors,” Lee lamented. “Chemical respondents are saying their new orders have been retracting for a long time now,” he said. “And backlogs of orders mostly have been contracting [since May 2022]. We had a little blip up at the beginning of the year [in January], but generally speaking, it hasn’t been positive news for chemicals.”

Chemical production was the worst-performing manufacturing sector in December 2022, and contraction continued in ISM’s May report. However, one chemical products respondent voiced an encouraging view in May, saying “Demand continues to gain momentum due to new business pipelines finally yielding billable production.

“Personal care and home care are drivers.”

Spring ‘rollbacks’

ISM mirrored that hopefulness in its spring forecast released during the ISM World 2023 Annual Conference in Grapevine, Texas, with the nation’s purchasing and supply chain executives predicting the economy will continue to “softly expand” for the rest of 2023. Lee pointed out this includes price rollbacks in the second half of the year. ISM reported a 2.3% year-to-date jump in net average manufacturing prices in May, but they’re expected to increase only 1% for all of 2023, so some softening is expected in the second half. Services prices rose 5.1% in the first half of the year but are expected to increase only 4.3% for the year, again reflecting an expected rollback, “but they’re still pretty [big] price increases,” Lee said.

ISM also expects “modest” gains in manufacturing and services capital expenditures, employee headcounts, and revenue in the second half of the year. In December, manufacturing anticipated a 5.5% increase in revenue this year, but that expectation was revised down to a 1.7% gain in ISM’s spring forecast.

“Growth is slowing—but the economy is still expected to grow,” Lee concluded.

About the Author

Jason McDaniel

Jason McDaniel, based in the Houston TX area, has more than 20 years of experience as an award-winning journalist. He spent 15 writing and editing for daily newspapers, including the Houston Chronicle, and began covering the commercial vehicle industry in 2018. He was named editor of Bulk Transporter and Refrigerated Transporter magazines in July 2020.