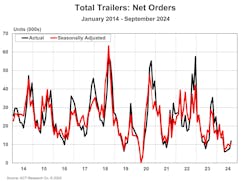

Trailer order intake improved month-over-month in September but remained relatively low compared to past years, according to new data from two research firms. ACT Research pegged the month’s net tally at 12,200 units, while FTR Transportation Intelligence reported trailer manufacturers booked 11,532 orders.

ACT’s September count brought its third-quarter order intake to 27,00 units and year-to-date order activity to 101,600.

“Build significantly outpaced orders again in September, but this time by only 4,500 units compared to August’s 11,000-unit drop, and backlogs contracted 7% sequentially,” Jennifer McNealy, ACT director of commercial vehicle market research and publications, said in a news release. “While down month-over-month, the backlog was dramatically lower (-55%) against 2023’s firmer backdrop.

“Trailer order activity, while improved from the last several months, remains tepid, despite anecdotal commentary that quoting seems to be increasing. In the present environment, the challenge is that while quotation activity is happening, order placement is slow and timing remains one of next year’s biggest ‘wildcards.’ In the meantime, the data continue to tell the story of macro-facing industry segments being particularly hard hit, with OEMs traversing a much more competitive landscape than the past several years.”

FTR reported September U.S. trailer net orders rose by 75% m/m from a low base to 11,532 units but were down 63% year-over-year. Net orders were the lowest for a September since 2016. Despite the opening of 2025 order boards, the industry’s net orders fell well below expectations, raising concerns for the upcoming order season.

The challenging truck freight environment in 2024 is continuing to suppress U.S. trailer demand, FTR continued. Year-to-date for 2024, total trailer net orders fell 31% y/y, reaching 92,642 units, averaging just 10,294 units per month. Total trailer build decreased by 11% m/m and 40% y/y in September, totaling just 15,617 units—the lowest monthly output since July 2020.

In September, total net orders were once again below production levels, causing backlogs to drop by 4,255 units to just over 82,750 units. The larger m/m decrease in production compared to backlogs pushed the backlog/build ratio up to 5.3 months. Despite this increase, it remains the second-lowest reading since July 2020 and is about 0.6 months below the pre-2020 historical average.

This ratio suggests that manufacturers still have incentive to slow production further, FTR concluded.

“Although trailer orders were weak in September, Class 8 orders slightly exceeded expectations at nearly 33,000 units for North America,” Dan Moyer, FTR senior analyst for commercial vehicles, commented in a news release. “This divergence suggests that some fleets are prioritizing spending on new power units over trailers, possibly due to reduced profitability or shifting trade cycles. Higher-than-ideal trailer inventories at dealerships, lower fleet capital expenditures on trailers, and shrinking backlogs likely will put downward pressure on trailer build rates for the rest of 2024.

“If trailer orders for 2025 don’t pick up soon, some OEMs may extend or expand production cuts into next year.”