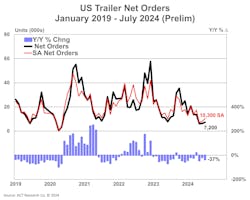

U.S. trailer orders increased from June to July, but they remained well below July 2023 levels, according to ACT Research and FTR Transportation Intelligence. ACT pegged its preliminary July tally at 5,961 units, a 26% month-over-month spike, and FTR reported 7,200 orders—about 1,000 more than in June.

ACT’s July order total is down 37% year-over-year, but a seasonal adjustment at this point in the annual order cycle boosts July’s tally to 10,300 units, ACT reported.

“This month’s data brings YTD 2024 U.S. trailer net orders to just under 82,000 units, a 26% contraction when compared to the first seven months of 2023,” Jennifer McNealy, ACT director of CV market research and publications, said in a news release. “Despite the sequential improvement in orders, July data continues to bear witness to our expectations of weaker demand against the backdrop of elevated order velocity the past few years, continuing weak for-hire truck market fundamentals, and already-filled dealer inventories.

“That said, it is important to remember that for orders, we remain in the weakest months of the annual cycle, minimally suggesting there is no catalyst for stronger orders before the fall and the OEMs’ opening of their 2025 order books.”

FTR’s July total is down 38% y/y after coming in “well below” seasonal expectations. It was 64% below the monthly average order level for the last 12 months. And despite the m/m gain, the July net order total was the fourth lowest in the past four years, with cancellations as a percentage of total gross orders above 30% for the third straight month.

Although some trailer segments experienced m/m improvements in net orders, the challenging freight environment is suppressing 2024 trailer demand, FTR added. Total trailer build decreased by 10% m/m and 26% y/y in July, totaling an output of 18,203 units. That figure is 19% lower than the average July build level over the past five years.

“FTR believes that some fleets may be prioritizing capital expenditures on new power units over investing in new trailer equipment, possibly due to reduced profitability or shifts in trade cycles,” said Dan Moyer, FTR senior analyst for commercial vehicles. “The upcoming opening of 2025 order books in a few months, along with a potential recovery in truck freight, could improve market conditions, although such an outcome is far from certain.”

ACT agrees, saying it sees fleets “starting to make more money” later this year, increasing their equipment purchasing ability.

“That improvement is off a very low base as carrier profits in the first half of 2024 were at levels not seen since early 2010,” McNealy said. “Looking to 2025, the trailer industry is also pressured by regulation, as we continue to expect fleets’ willingness to spend will lean toward the purchase of new power units ahead of the EPA’s implementation of 2027 regulations.

“Industry anecdotes suggest that the ‘pause button’ is expected to remain pressed through the remainder of 2024, although dealers are making progress in right-sizing inventory levels. However, cancellations remain elevated, resulting in trailer-maker concern about how long demand will stay subdued, as well as whether the supply chain will be ready to respond when demand does ramp.”