Report pinpoints top challenges for widespread battery-electric vehicle adoption

Incoming trucking environmental regulations and meeting shipper/customer needs have fleets exploring and implementing battery-electric vehicles in certain segments of the freight-transportation industry. The big question is how can the electric grid and existing infrastructure accommodate widescale BEV adoption across the U.S.? The short answer: They can’t right now.

According to the latest report from the American Transportation Research Institute, electricity supply and demand needs are “enormous,” BEV production comes with its own weight and price increase challenges for motor carriers, and truck charging requirements have the potential to create what ATRI called the “truck parking 2.0” crisis.

ATRI’s most recent analysis, a 2021 top priority of the institute’s Research Advisory Committee (RAC), was published as the federal government, states like California and various companies are discouraging the use of fossil fuels in transport. The report breaks down what ATRI’s RAC sees as the top challenges for nationwide vehicle electrification: U.S. electricity supply and demand, electric vehicle production, and truck charging requirements.

“Carbon-emissions reduction is clearly a top priority of the U.S. trucking industry, and feasible alternatives to internal combustion engines must be identified,” Srikanth Padmanabhan, president of the engine business for Cummins, said in an ATRI press release. “ATRI’s research demonstrates that vehicle electrification in the U.S. will be a daunting task that goes well beyond the trucking industry—utilities, truck parking facilities, and the vehicle production supply chain are critical to addressing the challenges identified in this research. Thus, the market will require a variety of decarbonization solutions and other powertrain technologies alongside battery electric.”

Al Barner, Fleet Advantage’s SVP of strategic fleet solutions, recently told FleetOwner that as more of the fleets that he works with are focusing on what the future looks like, they have doubts about whether they can actually implement an EV solution.

“It’s a challenge to build the infrastructure within your operating area,” Barner explained. “For example, in California, I’ve heard the permitting process could be as long as a year and a half. You have to start thinking about the infrastructure before you make the decision.”

To further compound those infrastructure and electricity concerns, in its report, ATRI pointed to additional headwinds, mainly the convergence of an aging electric grid, severe weather conditions, and the limitation of energy sources that have resulted in the increased frequency of power outages and brownouts across the U.S.

Electricity needs, materials, and BEV viability

ATRI’s study found that full electrification of the U.S. vehicle fleet would require a large percentage of the country’s present electricity generation. Domestic long-haul trucking would use more than 10% of the electricity generated in the country today, while an all-electric U.S. vehicle fleet would use more than 40%. Some individual states would need to generate as much as 60% more electricity than is presently produced.

ATRI’s analysis also quantified the tens of millions of tons of cobalt, graphite, lithium, and nickel that will be needed to replace the existing U.S. vehicle fleet with BEVs, placing high demand on raw materials. Depending on the material, electrification of the U.S. vehicle fleet would require 6.3 to 34.9 years of current global production. This is the equivalent of 8.4 to 64.4% of global reserves for just the U.S. vehicle fleet, the report noted.

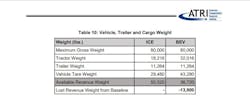

In addition, ATRI found that battery weight might substantially limit the long-haul capabilities of a BEV, calculating a lost revenue weight of 13,800 lb. for a BEV truck compared to an ICE truck due to battery size. Add to that potential revenue loss, and a Class 8 BEV could be two or three times the initial cost of its diesel counterpart.

“A battery-electric truck would be $380,000 minimum today and possibly $400,000-$500,000 per tractor,” Dan Murray, ATRI’s SVP, said during the recent Women In Trucking Accelerate Conference & Expo in Dallas. “You know how you charge your phone and use it for a couple years and then pretty soon it only holds half the charge? Guess what. That happens here.”

“So, you’re going to be switching out the batteries on a Class 8 truck every four to seven years,” he added. “When you switch out those batteries every four to seven years, you’re going to pay between $85,000 and $120,000 for a replacement set."

At the end of the day, taking into consideration the environmental impacts that are associated with mining raw materials for BEVs, Murray pointed out that battery-electric trucks are about 30% cleaner than diesel. Hydrogen fuel cells and renewable diesel options, on the other hand, are considerably less polluting, he added.

“I am going on a limb here ... I think over-the-road trucking is going to skip battery electric and go right to hydrogen,” Murray surmised.

In its report, ATRI concludes that while there are certain applications for battery-electric trucks, a completely new charging infrastructure is critical to increasing BEV truck adoption by the trucking industry. The research further documents that existing raw material mining for BEV batteries will likely need to be re-sourced with an emphasis on domestic mining and production.

“In the near term, there are discrete applications for BEV trucks,” ATRI stated. “Local and regional truck operations that rely on shorter trips and return the truck to terminals for nightly charging are feasible today.”

Fleet Advantage’s Barner pointed out that one viable application today is yard tractors.

“There are some really good applications currently for EVs, but as a wholesale change, I think it’s still a good five to 10 years or even longer away from that conversion,” Barner told FleetOwner.

Exacerbating the truck parking problem

Finally, ATRI’s report found that charging the nation’s long-haul truck fleet will prove challenging, partially due to the ongoing truck parking crisis. Current technology will necessitate more chargers than there are truck parking spaces in the U.S., with hardware and installation costs of $112,000 per unit, or more than $35 billion systemwide, ATRI explained.

Ultimately, ATRI also pointed out that regardless of advances in battery capacity or charge rates, BEV charging will be limited by hours-of-service regulations and truck parking availability. Other barriers, according to ATRI, also include laws preventing commercial charging at public rest areas and the remoteness of many truck parking locations.

“To understand the truck parking challenges, ATRI quantified the truck charging needs at a single rural rest area, which would require enough daily electricity to power more than 5,000 U.S. households,” the report stated.

ATRI’s full report, Charging Infrastructure Challenges for the U.S. Electric Fleet, is available to download.

This story originally appeared on FleetOwner.com.

About the Author

Cristina Commendatore

Cristina Commendatore is the Executive Editor of FleetOwner magazine. She has reported on the transportation industry since 2015, covering topics such as business operational challenges, driver and technician shortages, truck safety, and new vehicle technologies. She holds a master’s degree in journalism from Quinnipiac University in Hamden, Conn.